You gain greater visibility of your finances and can build a healthy savings account, while getting your debts paid off and your bills under control. Yet the financial power it could bring you is huge. The great thing about following the 70:20:10 rule is that it’s simple. Less fees mean more of your money for you. This exta step of transferring money can help with reducing spontaneous purchases.Īdditionally, the Everyday Options main and sub-accounts have no monthly account keeping fees, no transaction fees and 0% foreign currency conversion fees 3 on Visa Debit card purchases made from your main account. There is no card access with sub-accounts but if you do need a card for your ‘Fun’ bucket purchase you can easily transfer that amount back to your main account. Once you have your regular income going into your buckets, you can also set up your regular bills to be paid directly from the right bucket. You can transfer funds freely between your main account and sub-accounts at no additional cost so setting up transfers for the 20% and 10% each payday can be done easily. They can work well for the ‘Debt’ and ‘Fun’ buckets in the 70:20:10 rule. Sub-accounts allow you to pay bills directly via BPAY, direct debit or recurring transfer. You can then choose to add up to 9 sub-accounts 2. Under the 70:20:10 rule this account could work well as the ‘essentials (or 70%) bucket’ where you get your regular pay deposited. With the Everyday Options Account, you’ll get a main account which is your day-to-day transaction account with debit card access 1 for withdrawing cash and making purchases on the go. It also ticks the boxes when it comes to fees and flexibility. Suncorp’s Everyday Options Account has been designed with bucketing in mind. Bucketing with the Everyday Options Account This ensures the money is set aside in your buckets before you have a chance to access it.

Setting this up in online banking means you may be less likely to forget to move the money manually each pay cycle. Once you’ve chosen your bank and your buckets are set-up, it’s time to fill them! Setting up a recurring transfer from the account where your income is paid to regularly top-up each of your separate buckets is an easy way to put the rule into action. As most bank accounts today provide easy online access to view your balance and your transaction history, using your bank accounts for bucketing can help.

Budget percentages guidelines how to#

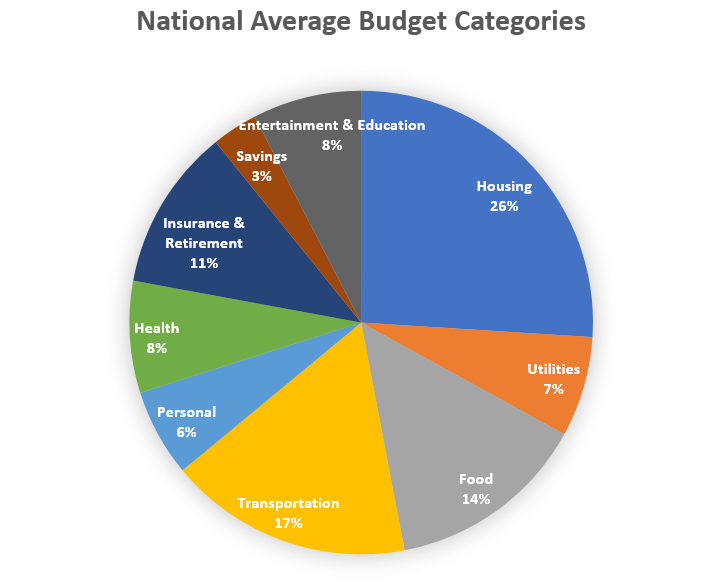

How to ‘bucket’ your moneyīucketing your money and the 70:20:10 rule are complimentary budgeting techniques that both involve splitting your money for set purposes. Using another budgeting technique known as bucketing, where your funds are physicially separated into different accounts with a defined purpose, can also compliment the 70:20:10 rule by helping help you keep track of where you may be overspending. Splitting your income into these set categories can help you control your daily spending, keep on top of your debt and empower you to build your savings. The remaining 10% is your ‘fun bucket’, money set aside for the things you want after your essentials, debt and savings goals are taken care of. The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered.

The 70:20:10 rules works by allocating percentages of your money into three categories. The 70:20:10 rule is one budgeting method that has gained popularity in recent times due to its simplicity. Budgeting for the essentials and the fun stuff isn’t always easy.

0 kommentar(er)

0 kommentar(er)